- The Digital Asset Daily

- Posts

- Gold’s Pause Just Lit Bitcoin’s Fuse

Gold’s Pause Just Lit Bitcoin’s Fuse

Every time gold cools off, bitcoin catches fire. It’s happening again.

Gold Is Catching Its Breath – That Means Bitcoin’s About to Catch Fire

Gold is the hottest commodity on the planet right now.

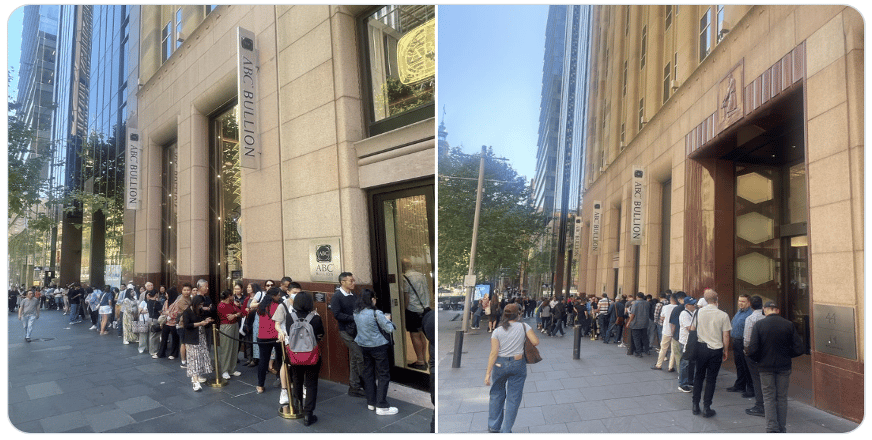

Just last week, crowds in Australia were lining up around the block to buy gold and silver bars – like it was 1979 all over again.

Australians line up to buy gold and silver. Source: Tom Richardson on X

I wasn’t born in the 1970s. But I’ve heard the stories – families struggling with sky-high prices, savings wiped out by inflation, markets in chaos.

It was a dark time for most investors… except those who owned gold. That’s when the yellow metal went from a forgotten relic to the decade’s top-performing asset.

Gold prices rose from $135 per ounce in 1977 to a high of $850 per ounce in 1980 – a 529% move higher in less than three years.

I’m a student of history.

So when the bottom fell out of the economy during the early days of the pandemic, I followed the same playbook I’d read about countless times.

As you may recall, in early 2020, the world was shutting down. Markets were in freefall. My friends were terrified about their jobs and their savings.

But instead of panicking, I turned to what I believed was the safest trade on the board: gold.

It turned out to be one of the best decisions I ever made.

From March-August 2020, gold soared as much as 43%. The VanEck Gold Miners ETF (GDX) went up as much as 180%. That’s more than a 4x greater return over the same time.

For a few months, it felt like I could do no wrong. I booked seven triple-digit winners in under 30 days on gold and silver miners.

But then something changed…

By late summer of that year, the mood began to shift. The world realized the lockdowns wouldn’t last forever. The panic faded. And all that safe-haven money sitting in gold started looking for a new home – something with more upside.

That’s when I rotated out of gold and into bitcoin and Ethereum.

I went all in. And that decision changed my life.

A year later, bitcoin exploded from $5,400 to $65,000 and Ethereum from $400 to $4,400. That translates to gains of 1,085% and 1,000% in under a year.

Those weren’t just good trades – they were life-changing trades. It would take you an average of 26 years to make those types of returns from the S&P 500.

Here’s why I’m telling you this story…

I believe we’re about to see a similar rotation out of gold and metals… and into bitcoin and altcoins again.

And the initial spark that sets it all off won’t come from Wall Street or Silicon Valley. It’ll come from a single decision made behind closed doors this week… and I believe it will send shockwaves through a small corner of the crypto market.

Big T Issues AI Warning for November

In 2015, Teeka Tiwari predicted the rise of AI and singled out Nvidia before it soared 24,037%.

Now, he’s back with what could be the biggest AI prediction of his career.

Teeka believes a single event on November 19 involving the man many call “the Steve Jobs of AI” will trigger the final phase of this AI boom.

But here’s the twist… It won’t come from AI stocks.

According to Big T, the biggest gains will come from a special set of coins that are quietly combining blockchain with AI — and positioning early investors for what he calls “the next Nvidia-level breakout.”

On Wednesday, November 12 at 8 pm ET, Teeka’s hosting a free online strategy session where he’ll reveal:

The little-known AI coins crushing the hottest AI stocks out there, in some cases returning 500 times more money…

Reveal the hot new AI application that’s helping drive these coins to the moon. HINT: The CEO of Nvidia predicted this will be a multi-trillion dollar opportunity…

His top six AI coins for 2026 and even give away a free pick that will give you direct exposure to what has been called “the future of AI.”

If you missed the early AI stock boom… this is your shot at redemption.

Gold Is a Reliable Indicator for Bitcoin